The Key Factors

These notes are not meant to be exhaustive, nor are they meant to convey the full understanding of what’s involved in a business acquisition or merger project. I provide them for prospective business buyers so they can get some scope of what needs to be done for successful find and negotiate a successful transaction. You should contact me directly for a full understanding. In my experience, it doesn’t matter whether it is a business acquisition or merger. These key features:

• Your financial capacity.

• Your experience, knowledge and skills.

• Your preferred locations.

• Your tolerance for risk.

Financial Capacity

Funding from 3rd party institutions is limited. Generally, this criteria is usually applied:

• Business buying Loan Value Ratios (LVRs) is limited to 50% of the price paid.

• Unencumbered property is required as security for any lending.

• Experience in business or the industry is required.

The cash amount for the investment really determines what can be acquired.

Preferred Location

Buyers of proprietor owned and operated businesses preferred to be within 30 minutes drive or less from the business premises.

Most investors will want to be able to visit the premises of location regularly, certainly in the period after settlement and causally thereafter.

Knowledge, Experience and Skills

Businesses required varying levels of knowledge, experience and skills depending on their stage of development. A proprietor-owned and operated business needs you to work in the business and to be able to fulfil operational and administrative roles. Larger businesses require different skills to plan, organize and supervise directly with in the business. At even higher levels, those skills will be broader and cover operational, administrative and financial abilities to plan, coordinate and control groups within the business.

Tolerance for Risk

Everyone has a difference tolerance for business risk. Owning a business is about taking risks. Financial rewards are the result of taking business risks. There is no such thing as a risk free business

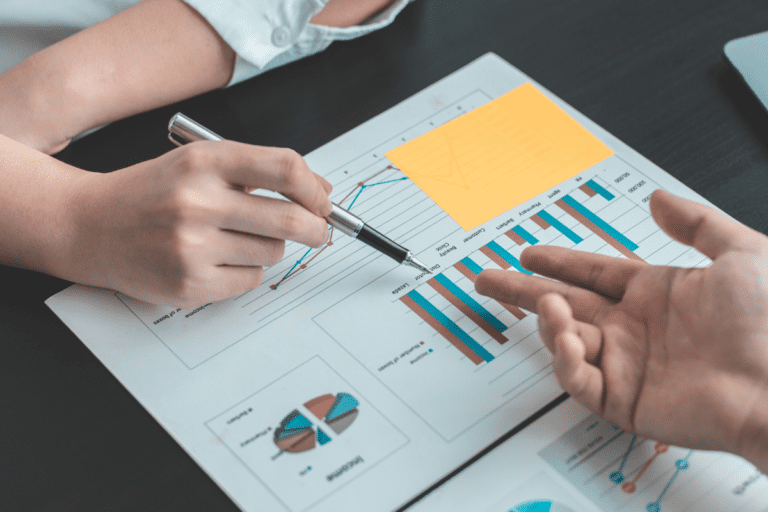

Financial Reports

Financial reports show the financial performance of the business is the past, not the future, although they are a good indicator of trends in the information reported.

The ability to ‘read and understand’ financial reports is essential. It is a must have for a business buyer.

Financial reports do not ‘tell the whole story’. Only an engagement with the sellers will ‘tell the story’.

Engagement

Direct engagement facilitates such as understanding of the nature and physical environment of its location, premises and lease; its plant and equipment; its history and development, its business day to day operations and its future outlook; its interface with customers and suppliers and trading terms and its management practices.

No amount of ‘interrogation’ of financial reports will reveal these factors.

Engagement with the Sellers and an inspection of the business operation is a must do.

Confidentially

Businesses, by their nature hold private information on the business itself, its owners, employees, customers, supplier and 3rd party advisers. Be aware sellers are most sensitive about these aspects. Don’t expect them to reveal such details without formal Confidentiality Agreements in place.